Whiskey isn’t just a beloved spirit and cultural institution—it can also be a highly profitable investment. Continuing with our theme of alternative investing, as discussed in our previous post on music royalties, whiskey presents another compelling opportunity that can significantly enhance your portfolio.

Over the past decade, the price performance of fine whiskey has outpaced nearly all mainstream assets, including U.S. equities. While common bottles of whiskey may not be worth much, certain bottles and casks can appreciate significantly over time, sometimes reaching values of hundreds of thousands or even millions of dollars. With the U.S. whiskey industry estimated at around $11 billion and projected to grow to between $16 billion and $18 billion over the next five years, whiskey presents a compelling alternative investment opportunity.

At QFS, we understand the value of diversifying portfolios with alternative investments, and whiskey aging is one of the exciting opportunities we explore through our exclusive access to strategic partners. Here’s what you need to know about investing in whiskey.

The Appeal of Whiskey as an Investment

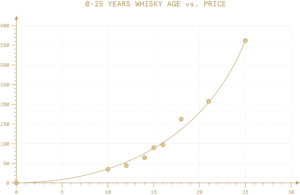

The primary allure of whiskey as an investment lies in its aging process. As whiskey matures in oak barrels, it not only develops richer flavors but also increases in value. This aging process creates a steep “aging curve,” where older whiskey is significantly more valuable than new-fill whiskey. For instance, a new-fill barrel might sell for $1,000 to $1,300, while a four-year-old barrel could be worth between $3,500 and $4,500. This increase in value makes whiskey aging a particularly attractive investment.

Additionally, whiskey is a global asset with demand spanning across wealthy communities worldwide. The combination of cultural significance, aging potential, and global demand contributes to the high value of certain whiskey bottles and casks.

How to Invest in Whiskey

Investing in whiskey can be done in two primary ways: by purchasing bottles or by buying whiskey by the cask.

- Investing in Whiskey Bottles:

- This approach involves purchasing bottles of whiskey and holding onto them with the expectation that they will appreciate in value over time. High-end bottles, such as the Macallan 72-Year-Old, can sell for hundreds of thousands of dollars. The value of these bottles is often driven by factors such as the whiskey’s age, brand reputation, and cultural significance.

- Investing in Whiskey Casks:

- A more sophisticated and potentially lucrative way to invest in whiskey is by purchasing casks. Casks are barrels of whiskey that are aged for several years before being bottled. The investment strategy here is to buy new-fill casks at a lower price and sell them once they have matured and increased in value.

The Driving Forces Behind Whiskey Prices

The sustained increase in whiskey prices is largely due to the simple economics of supply and demand. Global demand for fine whiskey continues to grow as the world becomes wealthier, but the supply of whiskey is inherently limited by the time-intensive aging process. Unlike wine, where vintages can vary, whiskey consistently improves with age, leading to a steep price appreciation curve.

Additionally, certain rare and aged whiskies come from “ghost” distilleries—distilleries that have closed down and no longer produce new whiskey. The scarcity of these bottles adds to their value, much like the artwork of a deceased artist. For example, the Macallan 1926 “Fine and Rare” bottle, one of only 14 in existence, sold for $1.9 million in 2019.

Why Invest in Whiskey Now?

The whiskey market is currently benefiting from a perfect storm of factors that make it an attractive investment:

- Global Demand: The appetite for fine whiskey is growing worldwide, especially in emerging markets like India and the United Arab Emirates.

- Limited Supply: Only a handful of countries, such as Scotland, Japan, and the United States, produce whiskey that is considered truly exceptional. This limited production ensures that the supply remains tight.

- Aging Process: Whiskey continues to improve with age, and the older it gets, the more valuable it becomes. This creates a predictable appreciation curve that investors can capitalize on.

- Cultural Significance: Whiskey is more than just a drink; it’s a cultural icon with a rich history. This adds a layer of emotional value that drives up prices, especially for rare and historic bottles.

Conclusion

Whiskey aging presents a unique and potentially profitable opportunity for investors looking to diversify their portfolios with alternative assets. Through our exclusive access to strategic partners, QFS provides clients with the ability to explore this market and capitalize on the significant appreciation potential of aged whiskey. Whether you’re interested in adding a bottle of rare whiskey to your collection or investing in the long-term growth of casks, whiskey offers an intriguing blend of culture, history, and financial opportunity.