For high-income earners, taxes are the biggest drag on wealth growth. But with strategic tools like ordinary loss harvesting, you can potentially keep more of your earnings and accelerate...

When thinking about long-term investment strategies, one sector stands out as a cornerstone for both resilience and growth: infrastructure. Infrastructure investments offer a unique combination of steady income,...

We’ve discussed before how investing in real estate can be one of the most effective ways to build long-term wealth. A natural first step in this journey is...

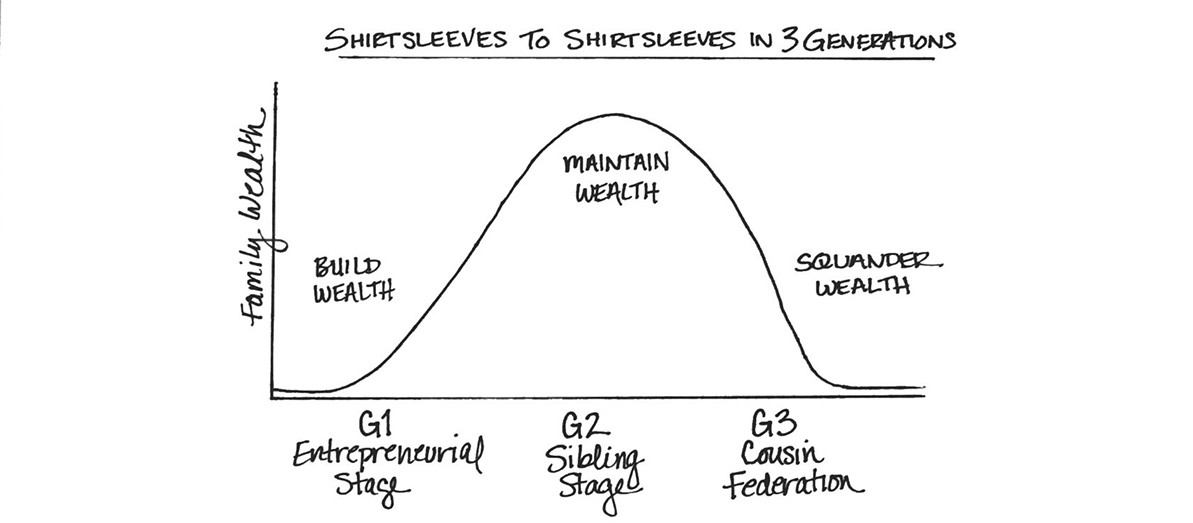

Building wealth is hard, but keeping it within the family over multiple generations can be even harder. The well-known saying, “Shirtsleeves to shirtsleeves in three generations,” highlights a...

Five Obvious Ways to Save More Money Than You Are Currently Saving money can sometimes feel like an uphill battle, especially when there are so many competing demands...

The concept of taxing unrealized gains—profits that exist on paper but haven’t been cashed in—is gaining traction, especially with proposals like the one from Vice President Kamala Harris....

Whiskey isn’t just a beloved spirit and cultural institution—it can also be a highly profitable investment. Continuing with our theme of alternative investing, as discussed in our previous...

In today’s ever-evolving investment landscape, diversifying your portfolio has become more crucial than ever. Traditional assets like stocks and real estate remain fundamental, but alternative investments are increasingly...

In a previous blog post, we discussed why investing in real estate has long been a cornerstone of wealth-building strategies for taxable investors. In this post, we’ll explore...

Deciding when to start taking Social Security is one of the most significant financial decisions you’ll make as you approach retirement. While conventional wisdom often suggests delaying benefits...