At QFS, we believe in staying ahead of the curve by investing in groundbreaking technologies that are shaping the future. One of our key focus areas is artificial intelligence (AI), particularly through exclusive access to the private markets where the foundational infrastructure for AI is being built. Unlike the well-known public stocks like NVIDIA, our investments target the critical infrastructure in private markets, providing a unique edge in the rapidly evolving AI landscape.

The Strategic Role of Data Centers in AI Evolution

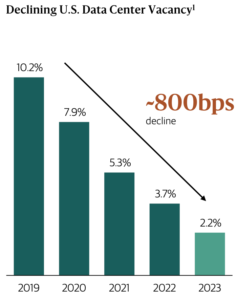

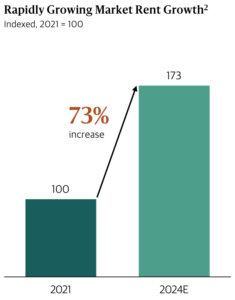

More data has been created in the last 3 years than in all of history combined. AI’s rapid advancement has driven an exponential increase in demand for data centers, the backbone that powers AI technologies. Data centers play a crucial role in both AI training and inference, with the latter requiring significantly higher capacity to deliver real-time AI capabilities to consumers and enterprises. This increased demand has strengthened fundamentals, resulting in declining vacancies and accelerating rent growth.

Our Exclusive Investment Opportunities

At QFS, we are strategically investing in data centers, including QTS, the fastest-growing data center company in the world. These high-growth opportunities are typically hard to access due to their presence in private markets, but through our exclusive partnerships, we provide our clients with unique exposure to these industry leaders.

For example, we have invested in CoreWeave, a key player in the AI ecosystem, which powers the development of generative AI by building and operating high-performance graphics processing unit (GPU) infrastructure. This investment allows us to support and benefit from the increasing compute requirements of AI technologies.

We also have exposure to Digital Realty, the largest global hyperscale data center operator. This partnership involves developing new data center sites in strategic locations like Northern Virginia, Frankfurt, and Paris, supporting the growth of AI and cloud services.

QFS holds a stake in the majority buyout of Winthrop Technologies, Europe’s leading data center delivery provider. They provide a full suite of services from designing, constructing, and commissioning to digital technology clients including some of the top global cloud providers. We anticipate an 18% CAGR over the next five years for Winthrop’s data center construction market.

Differentiating from Public Market Investments

While public market investments in AI companies like NVIDIA are well-known, they often come with high entry multiples and idiosyncratic risks. In contrast, our approach focuses on private market investments, which offer direct exposure to AI and digital infrastructure through specialized companies. This strategy not only provides diversification but also leverages our ability to structure innovative investments that capitalize on long-term growth trends in AI and digital infrastructure.

Conclusion

QFS is committed to leading the charge in AI investments by leveraging our exclusive access to private markets and strategic partnerships. By focusing on the critical infrastructure that powers AI technologies, we provide our clients with unique opportunities to benefit from the AI revolution without the high entry multiples associated with public market investments today. As AI continues to transform industries and drive demand for data centers, QFS remains at the forefront, investing in the future of AI and digital infrastructure.

Visuals courtesy of Blackstone, from “Behind the Deal: QTS Data Centers $10 billion privatization of the fastest growing data center company”

1DatacenterHawk, as of December 31, 2023.

1DatacenterHawk, as of December 31, 2023. Represents vacancy as of year-end.

2Wells Fargo. Represents estimated cumulative market rent growth between 2021 and year-end 2024. Full-year 2024 estimated as of February 28, 2024. 2022 and estimated 2023 market rent growth as of December 14, 2023.There can be no assurance that such rents will actually be achieved, and this information should not be considered an indication of future performance.