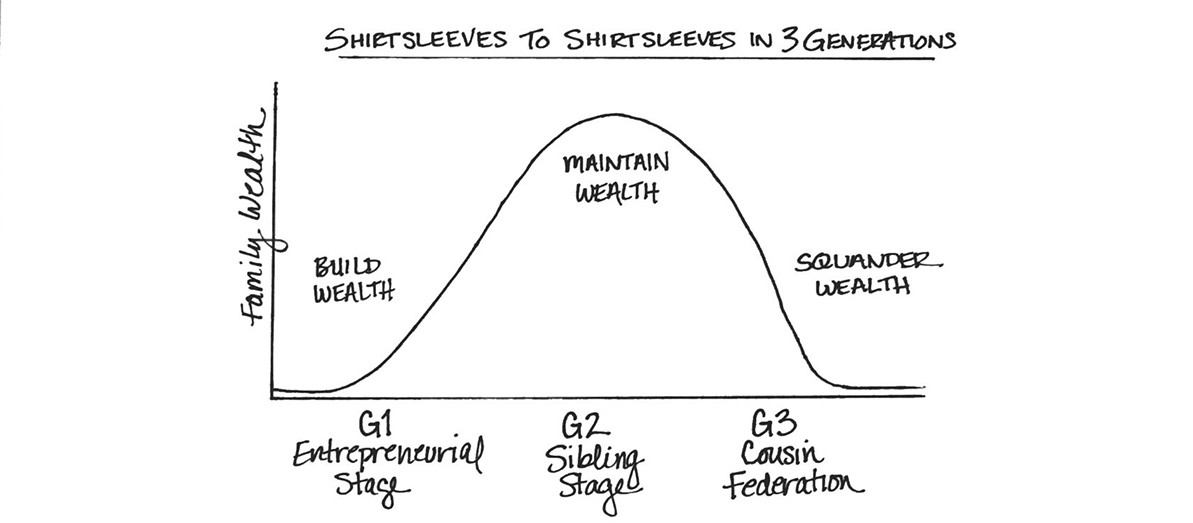

Building wealth is hard, but keeping it within the family over multiple generations can be even harder. The well-known saying, “Shirtsleeves to shirtsleeves in three generations,” highlights a pattern where family wealth often fades after just a couple of generations.

The numbers are startling:

- 70% of generational wealth is lost by the second generation.

- 90% of generational wealth is gone by the third generation.

This pattern was first brought to light by research from The Williams Group, a family wealth consultancy firm. They studied over 3,250 affluent families and found that these families failed to sustain wealth across generations at an alarming rate.

Why Does Wealth Disappear So Quickly?

- Lack of Financial Education

- One of the biggest reasons generational wealth vanishes is due to a lack of financial literacy and education in younger generations. The original wealth creators often have the skills and discipline to build wealth, but unless these principles are passed down, the heirs might not understand how to manage or grow it.

- Changing Lifestyles

- As wealth is passed down, family members might adopt lifestyles that are far removed from the frugality that built the fortune. Increased spending, riskier investments, and a lack of financial planning can rapidly deplete family assets.

- Poor Estate Planning

- Another common issue is poor or insufficient estate planning. Without clear guidelines and strategies for preserving wealth, inheritance can lead to family disputes or poorly timed financial decisions, further eroding the fortune.

- Failure to Involve Heirs in Wealth Management

- Often, the next generation is not involved early enough in managing the family’s assets. Without preparation, they may not be ready to handle the responsibility when the wealth is transferred.

How to Preserve Generational Wealth

- Financial Education

- To prevent the loss of wealth, families must prioritize financial education for younger generations. Teaching children about saving, investing, and wealth management early on can set them up for success.

- Sustainable Estate Planning

- Working with financial advisors and estate planners can help create strategies that protect wealth across generations. This includes using trusts, tax-efficient investing, and planning for liquidity events.

- Involve Heirs Early

- Successful families often involve their children and grandchildren in the wealth management process from a young age. This helps heirs become familiar with the responsibilities they’ll eventually take on.

- Value-Based Wealth Transfer

- Some families establish a set of values that guides how wealth is used and preserved. By focusing on long-term goals—such as philanthropy or business ventures—families can create a legacy beyond just financial wealth.

Conclusion

Breaking the cycle of “shirtsleeves to shirtsleeves” requires more than just building wealth; it demands careful planning, education, and active involvement from every generation. Families that approach wealth as a shared responsibility, with an emphasis on values and sustainability, are far more likely to buck the trend and preserve their legacy for generations to come.